What If Gas Prices Have Peaked? What Would That Mean For Truck Buyers?

Jason Lancaster | May 30, 2014 | Comments 14

“What if gas prices have peaked?” It’s a question I asked myself a few weeks ago, and it’s become a bit of an obsession for me since then. Partially, I’m curious about national gasoline prices, how they fluctuate relative to oil prices, how consumer usage of gasoline effects pricing, etc. Partially, I’m curious because automakers are working awfully hard to produce vehicles that consumer less fuel.

As far-fetched as it may sound, gasoline prices may have peaked (or may be peaking soon).

Demand For Gasoline In The USA Has Almost Certainly Peaked

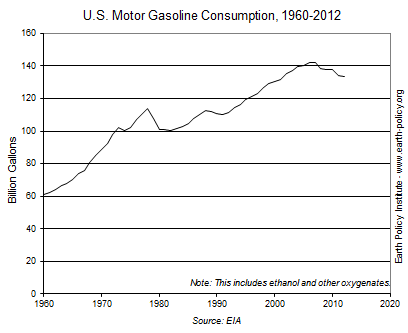

Americans are burning less gasoline (and diesel) now than they did in 2007. Even projections for 2014 and 2015 – which are based on continued economic growth – show gasoline consumption isn’t going to increase (see eia.gov). While the sudden decline in gasoline use in 2008 was almost certainly a result of economic contraction, it’s not the only factor at play here.

US gasoline consumption by year. Image courtesy earth-policy.org.

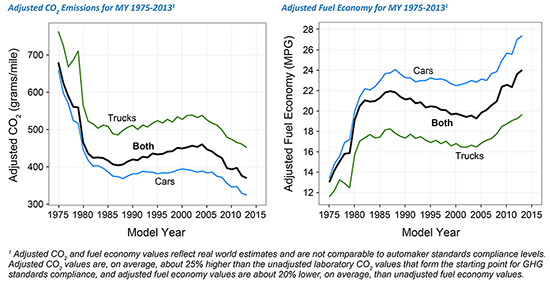

The fact is, vehicles are more fuel efficient now than ever before, mostly as a result of federal fuel economy regulations.

The average vehicle in the US is considerably more fuel efficient now than ever before. Image via WashingtonPost.com

In addition to regulations, gasoline demand is falling because consumers have bought more fuel efficient vehicles over the last few years. Automakers have made fuel saving technologies like direct injection, transmissions with more gears, and hybrids more affordable. A declining interest in driving among America’s youth has decreased demand for gasoline as well.

Still, regulations have played a big role in making the average vehicle more fuel efficient…and those regulations are about to get a whole lot tougher.

If we look into our crystal ball, it seems likely that gasoline demand will continue to fall. Consider:

- Americans are driving less, especially young Americans

- EPA fuel economy regulations are getting substantially more strict over the next decade – average vehicle fuel economy must double by 2025 compared to 2010

- Alternative fuels and powertrains (like CNG, fuel cells, and battery-electric cars) are only going to get more popular, and these types of vehicles don’t burn any gasoline at all.

When you add it all up, it’s very likely that the USA will never burn more gasoline than it did in 2007.

What About Global Gasoline Demand?

It’s all but certain that gasoline demand in the USA is going to decrease annually. The trouble is, the USA isn’t the only country burning gasoline. There are billions of people in the world that don’t own cars, and many of them are going to buy cars very soon.

However, according to Exxon-Mobil’s 2014 Energy Outlook report, global demand for gasoline isn’t going to grow much longer:

[This decrease in consumer demand for gasoline after 2020] won’t be because of fewer vehicles in the world. In fact, from 2010 to 2040, the number of light-duty vehicles…is expected to more than double. [However,] the increase in the number of light-duty vehicles in the world through 2040 will likely be nearly offset by the fact that the vehicles themselves will be far more fuel efficient.

Even if China and India buy lots and lots of cars, these cars are going to be efficient. As US demand for gasoline falls, global demand for gasoline will just barely pickup the slack. By 2020 (or so), global consumer demand for gasoline is going to decline.

Does A 25% Increase in Oil Demand Mean Higher Gas Prices?

Of course, consumers aren’t the only ones burning petroleum. From air travel to cargo ships to industrial processes, Exxon-Mobil anticipates global demand for petroleum will increase about 25% by 2040. Which means that even if gasoline demand falls, petroleum demand will increase. But does an increase in petroleum demand lead to higher gas prices?

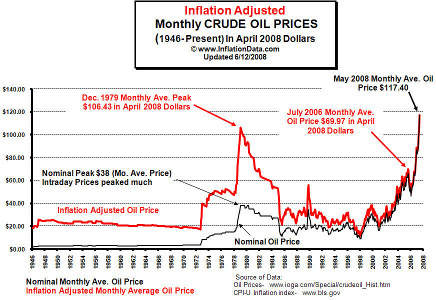

If you look at the volatility of oil pricing over the last 60 years or so, you see multiple dramatic price swings:

Crude oil prices from 1946 to 2008, inflation adjusted. What this chart doesn’t show is a dramatic drop off in oil prices in 2008 and 2009 that still hasn’t recovered to 2007 levels. Image via SeekingAlpha.com. Click for a larger view.

For 25 years after World War II, oil pricing was stable, even though demand was increasing dramatically. Then we had an energy crisis and a 15 year period of high prices…and then oil prices went back down to about what they were before (inflation adjusted). This price increase and decrease was a result of a few things, including:

- As oil prices increased, consumers bought more efficient vehicles.

- As oil prices increased, oil companies worked hard to discover and produce new sources of oil. US government policies were also changed to encourage domestic oil production.

- OPEC lost their stranglehold on the global energy market.

Oil prices went from “sky high” to about what they were in the 50’s and 60’s (inflation adjusted), and they stayed at this lower price for nearly 15 years.

Granted, this is just one example of an oil boom and bust…but it’s a very relevant example, as we’re currently sitting in a similar situation in 2014. After a period of high prices, oil production is increasing daily. If global consumers can find a way to reduce their use of oil in a relatively sudden and dramatic fashion (perhaps by driving electric cars), we could see a repeat of the oil collapse in the 1980’s.

Or maybe not. Perhaps oil prices will increase with demand, and history won’t repeat itself. Who knows?

What Does All This Mean For The Truck Market?

To recap:

- US demand for gasoline has peaked because consumers are driving less, and because of increasingly strict fuel economy regulations.

- Global consumer demand for gasoline will peak in the next few years, as vehicles are getting more efficient.

- Global demand for oil is likely to increase substantially between now and 2040 (about 25%), but that increase in demand may or may not increase oil and gasoline prices.

If you own a truck, all of this information probably means that your gasoline bills probably aren’t going up (at least not much), and might potentially go way down.

What’s more, it means that truck manufacturers have a reason to be bullish about the truck market. It’s no coincidence that GM has brought back the compact truck, that Nissan is making a big investment in the next generation Titan and Frontier, that Ford is building an aluminum truck, and that Toyota and GM will both being making mid-cycle engine updates that may include a diesel. These manufacturers know that increased fuel economy is going to lead to lower fuel costs, and that’s going to boost interest in buying and driving a truck.

One of my favorite saying is that “predictions are hard – especially about the future.” Still, when you add it all up, there’s reason to wonder if we’ve seen the highest gasoline costs we’re ever going to see.

Filed Under: TundraHeadquarters.com

Thoughtful and detailed article Jason! If Exxon-Mobile is predicting a decline in consumption, perhaps they can lobby to get the ethanol in fuel removed 😀

Thanks!

We need a little ethanol to support the higher compression ratios newer engines have, but the current amout (10% by volume, if memory serves) will be just fine going forward. We might even be able to back it down…I can’t remember what I read about it once.

Basically, however, we need some sort of oxygenator to allow high compression engines to function as designed. Since leaded gasoline is officially “out”, I think ethanol is the solution the industry likes.

Have we seen the highest gasoline prices we are ever going to see? “No” we have not.

Why? Because in 1913 the US Congress shirked its responsibility under the constitution in “minting” the US Money Supply and established the Federal Reserve. This private quasi government institution is controlled by the bankers and Wall Street. The more money they print the more everything will cost. After all they control and game their “own” system to their benefit. The other 99% lose out.

As we all have witnessed over the last 10 years; each time the Fed says: “We are now going to have Monetary Easing”…..that means they are going to print more money, the wealthiest 1% will significantly wealthier, the other 99% will get poorer, and everything will cost more again because the value of the dollar has been devalued again.

What does “supply and demand” have to do with the cost of gasoline? Virtually nothing, just mere bubbles of a few cents one way or another that last only flickers of time. It’s just hogwash that the media throws at us every day.

I will concede that high gas prices can decrease truck sales. After all I am part of the 99% and in the inner city an electric moped is more economical than a truck. But if I am forced into a moped position it is because of the oversupply of money. However, if I am able to game the system like the 1% then I don’t care if gas is $10 a gallon.

So in 5-6 years when the Tundra has the new variable displacement engine and lighter weight that gets a combined 22MPGs in lieu of the current 15MPGs…..will it make any difference to me when gas is $6 a gallon? Or will it be a wash? Will I be hurting more or less in 5 years?

Yes – Predictions are hard.

It might not have been clear in the article, but I’m saying gas prices might have peaked when adjusted for inflation.

That’s a big difference to be sure, but it’s what I meant.

I have been investing in energy for 35 years.

Any talk of gas prices hitting a peak is a very short term view, and by short term I mean in the life span of a new truck, let’s say ten years.

People always talk about price fixing on the holiday weekends. They refuse to learn anything about the commodities markets. Memorial day gas prices are determined months before on the futures exchange floors not a few days before the 3 day weekend.

We seem to have a bit more supply of oil and nat gas at the moment and that means consumption will grow and price will stabilize at some point. Cummins is in joint development with Westport Innovations building natural gas engines for heavy trucking to use that 2.00 dollar fuel instead of new expensive low sulfur diesel. Will fuel prices stay low? In the short term possibly but, 10 years from now will be another story. That 12 MPG 3/4 ton F250 might cost a lot to run in 2024. My 6000 pound diesel truck gets 22 MPG but, diesel is already over 4 dollars and I drive a Subaru when I don’t need a truck. I am old enough to remember the lines for gas back in the 70s on the east coast. To think we will never see that again is foolish at best.

My recommendation to all is to buy a truck for use as a truck and a higher millage car to haul people around. It’s all up to you, pay now or pay later in 10 yeas when putting 8 dollar a gallon fuel in that nice 4 door luxury Tundra.

Randy makes a lot of valid points with regard to the Federal reserve and it’s roll in pricing of all commodities. But,,,,,,,,, I don’t buy into the 1 percent stuff. The one percent hold little in terms of the whole picture. There are millions of F150s being bought by the 99 percent as apposed to the 1 percent who purchase those few 250 grand italian sports cars. Kill of the 1 percent and we still face the same issues. Sorry Randy, I’m not buying that one. By the way I’m not in the 1 percent. Perhaps the 15 if I’m lucky and I don’t drive around in a truck when a 30 MPG car gets me to the destination. My money is much to valuable to be used on fuel.

I understand why you say that – all the people in the oil industry that I talked to about this question echoed the same thought.

But nonetheless, we have a major oil company predicting a drop in demand, we have new technologies challenging the supremacy of oil in the marketplace, we have global pollution concerns (China is particularly concerned about automotive pollution right now) that will reduce demand, and we have new supplies of economically recoverable oil being found daily.

I’m not saying gasoline prices *will* fall (inflation adjusted), but it’s not at all unreasonable to question the conventional wisdom that gasoline prices will rise. If you look at oil prices over the last 65 years, for example, higher oil prices are unusual.

Your point is perfectly stated but only in the short term. The energy market must be looked at in the long term, 10 years plus. Right now we have more reserves then we have had for many years and that will mean lower commodity prices.

Remember back in 2008 when gas spiked up. I knew a young couple who had just purchased a big Chevy Suburban the year before. The determined they could not afford it and sold it at a big loss. In 2011 they purchased another one. They can’t see the road a head and they only react to what the market condition was last week.

The new reserves of oil and Nat gas and lower consumer demand mean only one thing. Commodities futures prices must fall to consume the new reserves. In ten years or so we will be right back to the other side again. We don’t know exactly when it will occur but, energy resources are finite and market demand forces are well documents for almost 250 years since Adam Smith wrote Wealth of Nations.

Any commodity or service in surplus will demand lower prices to consume it.

So, the big 400 HP V8 luxury pickup is going to a bit less to run today, but what about in 2025 or 2030?

I am 60 and well remember the gas lines back in 1973 and 1978. They said we would be running out of oil in 20 years (2008). People will be saying the same thing 10 or 20 years from now or whenever the next upside down cycle in the market occurs. The future for trucks in the years ahead must be lighter and lower power. The Tacoma will have a grand run for as far into the future as I can see.

Larry – All good points.

Perhaps I’m a little too optimistic about the potential for fuel cell vehicles (FCVs), but I wonder if the days of petroluem’s pre-eminence are ending.

If we assume that FCVs are going to become cost-competitive with gasoline powered vehicles (and that’s what the DOE projects by 2020-2025), and we assume solar energy power continues to become more cost effective, I see an opportunity for the marriage of the two technologies that could be hard to pass up.

The trouble with solar is storage – we can’t really build an energy grid around solar, as people need power 24/7, and it’s just not feasible to turn fossil-fueled power plants on and off as needed. This is why Tesla is pushing their battery packs as a compliment to solar – they know that solar is limited by itself.

However, if we used solar to create hydrogen via electolysis (or a new photosynthetic process), we might have a commercially viable alternative to petroleum. Fuel cells work just fine for mass power generation (there are large power plants running off fuel cells now), so “excess” hydrogen could easily be used to power the electric grid.

Basically, solar could be used to “create” hydrogen, which could then power everything.

I’m working on this topic for another project right now, but suffice to say recent advances in catalyst technology have made both electrolysis and fuel cells substantially cheaper…what I’m describing might not be that far-fetched.

To be clear, our planet is going to use oil for a long, long time to come. However, if consumer use of petroleum were to fall 50% in the next decade worldwide, the market for petroleum would nosedive and likely never recover.

Or maybe not. 🙂

So where is it that gas prices are going down??

Certainly not in the Northeast!!!

Gas is right at $4 a gallon in my neck of the woods. My little 1985 Toyota with the 22RE gets about 23 on the hwy, so I guess I’ll still with it.

Been driving 1/2 ton trucks since early 90’s. I have seen NO, or very little say 1-2 mpg, at most fuel efficiency being increased in 1/2 ton trucks. Reason: All mfgs. are increasing hp/torque over the years more and more and the more ponies = more sucking gas.

If Toyota or anyone else would build a 300 hp V8 vs. pushing 400, maybe we would be getting 22 hwy mpg?

If gas goes up much over 4 bucks per gallon and stays there for say more than 1 year as gas does fluctuate but if it doesn’t, then the truck will be sold and will invest in a nice trailer that can be pulled with my V6 SUV that when NOT towing, gets 26 avg mpg. with 290 hp and around 275 lbs. of torque, plenty enough to pull 3-4000 lbs. around no problems.

Last week in November of 2012 right before the snow flew in WI here, I bought a 249cc scooter for 1 grand and driving that getting 63 avg mpg saves me over 4 bucks in gas daily driving to work. I figure in another year or so I’ll have that 1 grand paid for no problems. I sure hope it lasts me another 20K more miles since I let the truck sit every chance I get NOT driving it to work as a daily commuter.

I tell you though after reading the review on the new Dodge RAM 1/2 ton 3.0L diesel engine achieving as stated 28 hwy. mpg and 20 or more in the city for ONLY 2850 as an additional option, that is dirt cheap since most diesel upgrades cost 4-5 grand and even more than that.

I gotta give Dodge credit as the first and ONLY as of now mfg. to offer in a 1/2 ton a very fuel efficient diesel engine achieving wonderful gas mileage at very little cost upgrade.

Toyota needs to do something in 2015 or for sure 2016 since the game changer of 2007 is long gone and the tundra is now the worst fuel efficient 1/2 ton truck made.

Back in 1995 I purchased a 4WD T100 for around 15000. I kept it 18 years.

3.0L V6 and the curb weight was about 4500 pounds. At best it only got 19 on the highway. If I loaded it heavy it would drop to 11 or 12. I know I am in the minority but that was the truck for me. Almost no repairs in 18 years, muffler, some pipes, starter, the usual stuff can’t even remember anything else.

It only had about 150 HP so there was no way it could pull any load at 70 MPH. It was a great truck because it kept money in my pocket and out of toyota’s. It’s still on the road and running fine.

To pull anything I had to gear down and run the engine hard and it never quit. It takes fuel to move loads and it really doesn’t matter what size the engine is unless you are going to move that load at 75 MPH. Big motor, small motor, it takes about the same amount of fuel to move 6000 pounds at 55 MPH.

My 5.9L diesel gets 18/22 MPG which is great for a 6000 pound 3/4 ton truck. It has much more power then I need. If only the 4 cylinder version of that motor was available but, it’s not. They are getting bigger not smaller. The new RAM V6 diesel motor has been around for a long time and it might be a good choice for a light truck. So it looks like Ram will have another good diesel motor in a bad truck body. I just spend 3 days rebuilding the front components on my truck. Ball joints, U joints, bearings, added good old free hubs. The RAM 2500 front suspension simply can’t handle the weight of a big cast iron cummins motor.

I only wish they gave us more options for smaller engines (without turbos) and transmissions but, the truth is that people would not buy them. People won’t stop buying the big luxury trucks until gas moves up to 6 a gallon or they face unemployment and just can’t pay for them. That day is coming but, it’s still a few years away.

I definitely agree with your last sentence about buying luxury trucks and won’t stop until higher gas or unemployment or can’t afford them and that day is coming very soon.

I also don’t think 1/2 ton trucks gas mileage has improved over the past 20 years either maybe 1-2 more mpg at most all mfgs. have done is increase hp/torque from say 275 hp to near 400. Not needed but that is what most people want.