Toyota Releases 2013 Year-End Sales Figures – Tundra Keeps Pace

Tim Esterdahl | Jan 06, 2014 | Comments 7

The 2013 sales year has ended and Toyota says the Tundra has pretty much kept pace with the rest of the market. Is that a win or a loss for Toyota? Here’s our take.

The Toyota Tundra had an interesting year with the new truck being released. What’s your take, a win or a loss?

Before we debate the results of the year, let’s remember, it has been a year of change for the Tundra. The truck was officially revealed the first of February and the new trucks hit the dealers lots throughout the fall. As a consequence, sales were up and down throughout the year with the anticipation of the new truck and there were whispers of a supply problem of 2014 trucks in August and September.

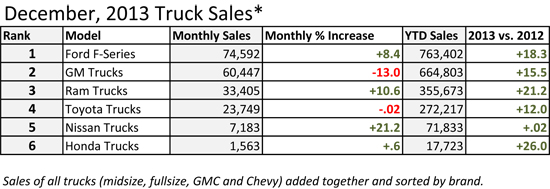

Officially, here is how the year ended with our unique sales chart that shows numbers per brand, not broken out by model. (BTW, tell us whether you like this chart or not).

Before we get to Toyota, we have to mention the really strong year that Ford and Ram had. Also, it is interesting that GM was down quite a bit in December (actually, overall GM was down 6.3 percent for the month – yikes!). Lastly, we see Nissan and Honda had a so-so year.

For Toyota, you can look at the numbers several ways (aren’t statistics fun!). Focusing on the Tundra, for December, the truck sold 10,988, +7.2 percent and for the year, 112,732 units sold – + 10.9%. With these numbers, you could argue that:

- The year was a WIN – they kept pace with the larger truck makers. Also, even though critics initially panned on the new truck, the truck sales didn’t tank as much as they made it seem.

- The year was a LOSS – with all the other makers seeing much larger gains, Toyota actually lost sales. We mean, you could argue with the Ford, Ram and GM each being 15% and over, Toyota lost sales with only being at 12%.

Of course, the sales numbers are really about bragging rights. The facts are that Toyota has never really challenged the “volume” numbers of the other makers, yet they have really held their own in the full-size truck market without many fleet, a diesel or an HD offering.

What do you think? Was 2013 a “win” or a “loss?”

Related Posts:

Filed Under: Auto News

I don’t know how much brand loyalty accounts for sales but I think it pays a big part. I have co-workers who’s on their 4th ford truck since I my ’00, I’m still on same truck.

4th Ford Truck?

Do you know why? Did they have trouble or just like getting new models? If they had problems, they went back to Ford?

Have any additional information.

I have a friend with a 2 year old F150 which had less then 7000 miles and he went back to get a new EcoBoost F150. He just likes to get new trucks. When we go river trips I like to joke that I can buy beer for the the next 5 years with the amount he loses every time he trades in a truck which is almost new. If only I could have gotten him to buy the model I wanted.

1st co-worker, 1st truck, just wanted a new truck. 2nd truck tranny went out at 13k and after getting fixed, traded for 3rd. 3rd truck just died around 50k, dont know why. 4th truck, he was still driving when he quit to work somewhere else, so I don’t know the status of they one. All 4 trucks are f150s. Also note, he mentioned his dad is a manager at a ford dealer.

2nd co-worker, 1st had front end rebuilt at 72k(f250), traded it in on a f150, had for a few yrs, trade for another f150. Currently back to a f250. This guy is a ford nut. Praises how good fords are and are very reliable. Yet none he owned past 70k range. Occasionally asks me how many miles I have. I just smile and tell him where its at.

I think loyalty and ties to ford has a big influence in them going back to ford. It over shadows issues they have. I currently have 264k and am the original owner.

I think toyota had a decent year in a good overall sales year. If they can get more capacity that they keep talking about to offer more options, features, etc I think they can gain some market share instead of losing it, they have build quality and reliability figured out, now the rest needs to come.

So I guess I view it as a positive in that the new truck is selling well, the tacoma is really selling well.

But the negative is that they are growing more slowly than the others for the whole year so they lost and are losing market share. This may not matter to them if they reach their sales target on a yearly truck sold basis, but it should matter to them.

as far as the table, the only thing is that you’ve included a mid-size truck in with all other trucks that are full-size. Yes, that includes the HD from the other brands but they are still full-sized. It’s interesting to see but I don’t know that makes sense.

What would be real interesting would be a 1/2 ton breakout full-size only. Those numbers are hard to get.

I know that if they can add some stuff, I would look at one again no problem when I go to buy again. I had 3 and they were good trucks, just a bit behind right now with features and options if that stuff matters to you. Long term reliability doesn’t matter as much to everyone (myself included) since I am on a pattern to trade every 3 years or 60K miles. Anything you buy will be fine in that time line unless you get a lemon which can happen from anyone.

Sales charts are always interesting. Most are unable to interpret them; but if you can, trends for the future can be garnered sometimes. There are several components that make them very poor barometers for the future. Ford, GM, and RAM include HD trucks. Toyota and Nissan do not sell HD trucks here, but they do include compact trucks which up to this date the other companies are not in the market place; at least in any appreciable way.

Here are a couple of examples: A) The Tundra’s year over year December sales growth rate is about 7.2%; that is only about 1.2% behind all of Ford’s sales which include HD sales. Of course any sane person knows the reason the chart only shows negative .02 is because the Tacoma when down about 10%. For October the Tundra growth rate was nearly double Ford’s and for November it was 50% more than Fords. Has Tundra ever outpaced Ford like that before? Maybe only momentarily at the launch of Gen 2 trucks? B) The Chevy Silverado (I excluded GMC) was actually down by 16% for December year over year; a major drop even with the average December discounts of $12,000 and 90 day supply (some dealers in Texas now have a 5 month supply) so now we are starting to see even larger discounts.

Things are not going well at GM. The Tundra by comparison has only a 15 day supply. What does that mean: It is a Cash Flow Crisis for GM vs. Toyota has Cash Coming In. Most of us are smart enough to know: this is really no problem for GM; they simply call their friend Bernanke and have him print more money. GM can continue making Silverado’s all day long; they don’t have to sell them. Put another way: We all pay for Silverado’s even if we don’t own one.

What would be really nice is to have break out sales charts by “size” compact, half ton, and HD; then John Q Public could have a better understanding of what is really going on and not be so easily swayed by marketing hype.

Amen to that Randy. I can’t even begin to say as to how it really frosts me about GM on the US taxpayers’ backs. They should be made to compete for every dollar just like the next guy, in a free market anyways. I guess therein lies the problem!!! I really do wish people would figure this out. Because, I, frankly absolutely despise bailing GM out on my every paycheck. Which exactly what’s going on!! I pretty let a lot of my auto magazine subscriptions lapse because I feel they are biased against Toyota. Go to a local newsstand, pick up any mag., nary any Toyota articles. They’ve all sold out to Obama trying to dissolve Toyota’s public perception of the brand. Car and Driver, Motor Trend and FourWheeler just to name a few examples.Please people cue in on this!! It never used to be this way.

Thanks for sharing, oh how I love stats! Even though Toyota had a loss, it’s still up since 2012 so I think that as a win. This is Toyota’s chance improve and stand out from its competition in the new year. I’m excited for what 2014 has to offer.