Is Tundra Market Share Sliding, or Are Fleet Sales Obscuring The Truth?

Jason Lancaster | Jun 10, 2011 | Comments 7

In an article titled “What Happened To The Tundra,” website AutoSavant.com offered a reasoned analysis of the pickup truck market, and – based on sales figures and market share – singled out the Toyota Tundra as underperforming.

While there are definitely some arguments to be made about Toyota mis-steps with the Tundra (everything from bad tailgate design to bed bounce / ride quality complaints to failing air injection pumps), it’s impossible to say that the Tundra is failing for two reasons:

1. None of the market share numbers offered in the AutoSavant number discount fleet sales.

2. Fleet sales should never be considered equal to retail sales, because fleet sales are dominated by the lowest cost product. Quality, reliability, etc. have nothing to do with fleet sales.

NOTE: If you’d like to argue my second point, read about why fleet sales don’t compare to retail sales before you do so.

The question is, if we take out fleet sales, how does Tundra market share look?

The Fleet Mix Mystery

Unfortunately, I don’t know exactly how many fleet trucks Ford, GM, Chrylser-Fiat, and Toyota have sold since 2007. All I have are rough percentages of total vehicles sold. That means that my estimates could be off by quite a bit.

HOWEVER, that doesn’t mean that we can’t come to some sort of meaningful conclusion. As you’ll see from the data below, it’s very likely that my analysis underestimates fleet sales for Ford, GM, and Chrysler-Fiat and overestimates fleet sales for Toyota. Here’s what we know:

- According to Ford sales VP Ken Czubay, about 50% of the F-series Ford sold in February 2009 went to fleets. This is probably the highest fleet mix we’ll ever see, mostly because consumers just about stopped buying pickup trucks in 2009.

- In April 2011, 34% of the vehicles sold by Ford went to fleets. This just might be the lowest percentage of fleet sold, seeing as how consumer demand for pickups has come back strong in the last 6 months.

- According to this article from The Truth About Cars (TTAC), Ford’s overall fleet mix in the first half of 2010 was about 35%. Again, this number isn’t specific to the F-series…but based on these comments from Ford sales analyst George Pipas, F-series fleet sales are always higher than the rest of the product lines.

- The same TTAC article I linked to above shows GM fleet at 31% and Chrylser fleet at 39% for the first half of 2010. Toyota? About 9%

So what do all these data points mean? My best guess is that at least 35% of truck sales at Ford, GM, and Chrysler-Fiat go to large fleets, and that (at most) 10% of Toyota and Nissan truck sales go to large fleets. If we adjust the truck sales figures reported between 2007 and 2010 using these estimates (35% fleet for Ford, GM, and Chrysler-Fiat, 10% fleet for Nissan and Toyota)…

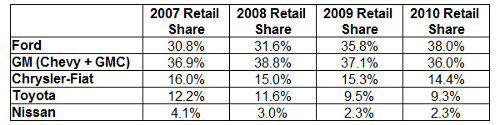

Estimated retail market share of pickup trucks by manufacturer, 2007-2010

We find that the changes in market share don’t look nearly as dramatic. To be sure, the Tundra has lost a share of the retail truck market…but how much? We’re assuming that only 35% of Ford’s truck sales are fleet, despite the fact that a Ford sales analyst said “Registration data shows that F-Series is the number-one fleet vehicle in the entire industry.”

If you agree that fleet truck sales and retail truck sales shouldn’t be compared to one another, and if you agree that our estimate of 35% fleet sales is low for Ford, then you must also agree that the table above is skewed in Ford’s favor. The numbers for Chrysler-Fiat – which has been struggling to stay alive the last 4 years – may also be low. GM’s numbers? They could be high!

I don’t know what the exact truck fleet mix is for each manufacturer in each model year, but neither do the fine folks at AutoSavant when they argue that the Tundra’s market share is falling. All they can do is roll retail and fleet sales into one big pile and then draw conclusions that, frankly, shouldn’t be drawn.

Based on conversations with folks in Toyota sales, I’m of the opinion that the Tundra’s share of the retail market place is only slightly lower than it was in 2007. This would explain why Tundra’s resale values remain high (consumers still trust the brand), for example, and it might also explain why Ford resorts to massive incentive spending every August to maintain their sales crown. If Ford’s share were really growing so strongly, why would they offer as much as $7500 back on a new truck? Seems like profitability would come first if market share were really increasing so rapidly.

Bottom Line: When Joe Consumer sits down to buy a new pickup, he’s likely giving just as much consideration to the Tundra now as he did 4 years ago. There’s not enough data to support the conclusion that Toyota has somehow “failed” with the Tundra.

Search terms people used to find this page:

- tundraheadquarters

Filed Under: Auto News

Here is my take. The f-150 and silverado/sierra and even the Ram are always going to have huge rebates every year so people will wait to buy one during that time frame when rebates are 4-5K, especially I feel GM and Ford. Toyota tundra, you are lucky to ever see 3K in rebates and now that Japan parts are in limited supply, I doubt the tundra will ever see 3K anytime soon unlike Ford and GM. More higher rebates more often mean more sales since consumers of course look at bottom sales figure, not re-sell later down the road. The tundras have higher re-sell in perspective to slightly higher cost to purchase due to lower rebates. For me, if the 2011’s or 2012’s tundras offer again a 3K rebate, I might consider trading in my 2010 tundra, until then, I am happy.

I’ve been trying for 4 yrs to get my company to understand that we don’t need to lease 2500 Rams for fleet, when the Tundra can do pretty much everything we need it to do, and for less than the $40K Rams. The response is always the same though, there’s about 5 employees in our company that for some reason think they need a 1 ton dually, so the company won’t divide up the fleet between two manufacturers for fear of getting a worse price on those 1 tons. My 08 2500 Ram has had way more recalls than my Tundra, and at 80K miles has been in the shop for repair 5 times in the last 2yrs for major problems. It would be in the shop again right now if it wasn’t for the fact that a new fleet truck just arrived to replace it. Unless Toyota follows through on the concept 1 ton design we’ll probably never get them for fleet, which means I get to look forward to more down time with the Rams.

I wrote two comments and either one of them appeared?

I agree with MK. Resale tells me if a Tundra is a failure. That .com needs to hire a new staff. They are like the GM rep who stated that the govt needs to increase the gas tax by another $1 so people would buy GM efficient cars. Hey GM rep the loonebin is in the corner of a round room.

NOTE: The writer of the article at AutoSavant has written a rebuttal to my argument that you can read here: http://www.autosavant.com/2011.....-look-bad/

Somehow, this writer’s comment and link to his rebuttal was lost. My apologies.

“Quality, reliability, etc. have nothing to do with fleet sales”

What a ridiculous statement! Purchase price + maintenance costs + downtime; are all huge factors when I make Fleet desisions.

John – Two questions. 1. What fleet do you buy for? 2. According to your metrics, what’s the difference in downtime between one brand and another?

Don’t give me personal anecdotes either – tell me what your NAFA guide says.